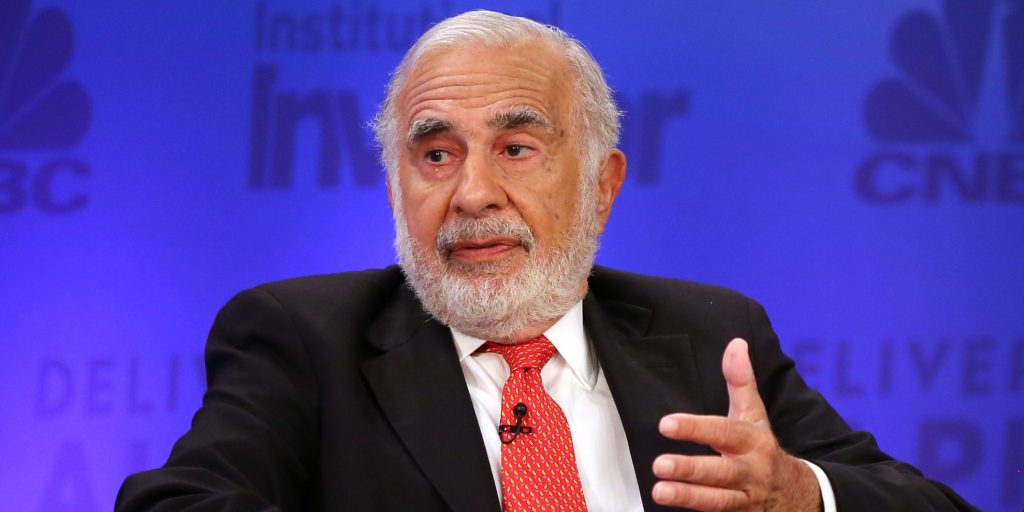

Adam Jeffery/CNBC/NBCU Photo Bank/NBCUniversal via Getty Images

- Excessive money printing by the Fed and high inflation will spell trouble in the long run, Carl Icahn told CNBC on Monday.

- The billionaire investor made his comments as retail and wholesale prices sit at multiyear highs.

- He said he doesn't invest in bitcoin but the crypto could be valuable if inflation runs "rampant."

Stocks over the long run are heading for a "crisis" eventually as an excess in money supply unleashed by the US government and the Federal Reserve add to inflationary pressures, billionaire investor Carl Icahn told CNBC on Monday.

"In the long run, we are certainly going to hit the wall," he said. "I really think there will be a crisis the way we are going, the way we're printing up money, the way we are going into inflation. If you look around you, you see inflation all around you, and I don't know how you deal with that in the long term."

The outbreak of COVID-19 in the US last year prompted two White House administrations and the country's central bank to pump trillions of dollars into the financial system. And lawmakers have passed at least $5 trillion in federal aid such as stimulus checks sent to Americans to help keep households afloat.

The boom in money supply has fed into a surge in inflation that has sent consumer and wholesale prices to multiyear highs. Supply-chain bottlenecks and labor shortages have also contributed to such pressures. The consumer price index in September climbed to 5.3% and wholesale inflation shot up to 8.6%.

Amid the high prices, Icahn acknowledged that bitcoin has potential. He told CNBC that he doesn't understand bitcoin nor does his company, Icahn Enterprises, invest in the world's most-traded cryptocurrency.

But he added it may hold value in the face of soaring inflation.

"If inflation gets rampant, I guess it does have value. But will inflation get rampant? Or will the government come in as they did in China and stop the thing?" he said.

Icahn added that there are "so many variables that it's a very difficult thing to invest in from my point of view."

Bitcoin prices have surged in recent days as the first-ever bitcoin-linked exchange-traded fund in the US is set to debut on Tuesday, with ETF provider ProShares behind the launch. The digital currency jumped above $61,000 during Monday's session.